The mortgage rates have touched lowest since 1971 in this week in the USA. For a thirty years fixed mortgage, the rate has dropped down to 4.12%. This was the best time for the Americans to buy their home as with such low rate of mortgage, they could have saved thousands of dollars every year.

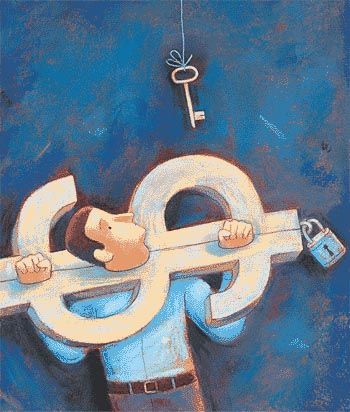

But the most astonishing fact is that in spite of such low rates of mortgage loan, there are only a few takers of this advantage. The main reason for this is the fact that many Americans are not in a position to pay the down payment on their home loans.

Most of them have either lost their jobs or are not in a position to save much as there was a freeze in their salary for the past few years. Many people are also so much down with debt that they do not have much savings. The housing industry is in still in a bad shape and is yet to take up in the past few years.

Due to the fear of double dip recession, people are scary also to invest in stocks and property because of the diminishing value of their prices. A bulk of the investment has shifted towards the US Treasury bonds since the returns are assured and guaranteed. However, the returns on US Treasury bonds have also touched all time low for the last ten years.