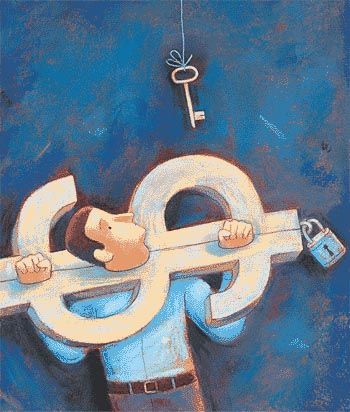

If you have a bad credit history, you are not likely to get any personal loan or credit card. Since you have a bad credit history, finance companies will not feel comfortable to give you any loan which is not secured. Hence, you will become eligible of getting only secured loan.

Secured loan is also better for you as it has got many advantages. First of all, the eligibility criteria of secured loan are much easier than a personal loan. Hence the chances of approval are easier in case of secured loans in case of persons having bad credit history.

Another advantage is that the amount of sum you can get is more than any personal loan. Moreover, you are likely to get a longer repayment term in case of secured loans and hence your monthly burden will be much lesser. The financial institution will also feel secured as they are having your home as mortgage. Hence if you become a defaulter, they will simply take away your home. So, you must be very careful in repaying your monthly installments in case of secured loan.

How long did it take you to write this? This is Absolutely fantastic.

very good article,thans for your sharing